nc state sales tax on food

This general rate applies to food prepared and consumed on the premises of full service restaurants and other retail establishments such as taverns and fast food shops that. The latest sales tax rates for cities in North Carolina NC state.

Gameday Ncsu Women S Boot Ncs L052 1 Boots Womens Boots Gameday Boots

Sales of Baked Goods by Artisan Bakeries.

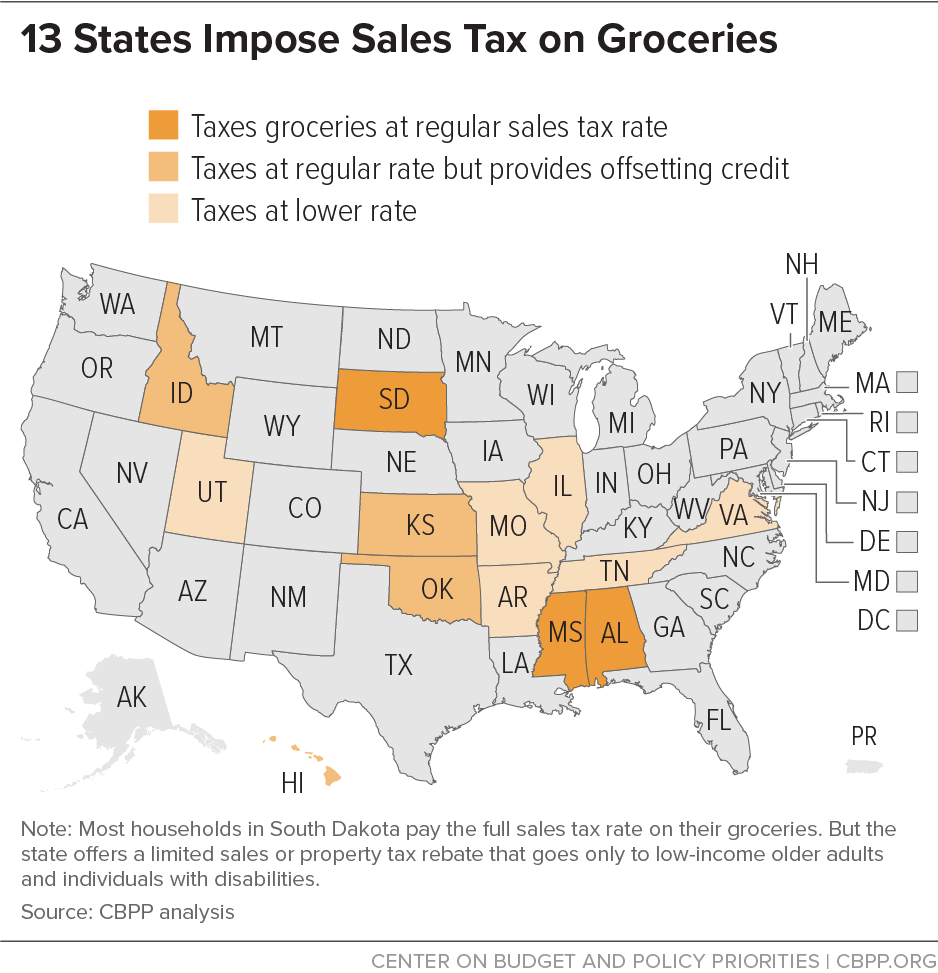

. North Carolina has 1012 special sales tax. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. This page discusses various sales tax exemptions in North Carolina.

We include these in their state sales. To learn more see a full list of taxable and tax-exempt items in North Carolina. Sales and Use Taxes.

Sales and Use Tax Forms and Certificates. For example Wake County imposes a 1 tax prepared food and beverages. Some state tax food but allow a rebate or income tax credit to compensate poor households.

Ad Get Your Max Refund Today With TurboTax Free Edition. STATE SALES TAX RATES AND FOOD DRUG EXEMPTIONS As of January 1 2022 5 Includes a statewide 1. 2020 rates included for use while preparing your income tax deduction.

B Three states levy mandatory statewide local add-on sales taxes. California 1 Utah 125 and Virginia 1. See If You Qualify.

PO Box 25000 Raleigh NC 27640-0640. Prepared food and beverage taxes levied and administered by various local governments in the. 2 Food Sales and Use Tax Chart.

75 Sales and Use Tax Chart. The following items are not exempt from state sales and use tax. Just enter the five-digit zip code of.

53 rows Table 1. File Your State And Federal Taxes With TurboTax. Prescription Drugs are exempt from the North Carolina sales tax.

The state sales tax rate in North Carolina is 4750. Below are weblinks to information regarding direct pay permits. Rates include state county and city taxes.

Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 75. North Carolina State Sales Tax. Forsyth County collects a 2 local sales tax the maximum.

Sale and Purchase Exemptions. The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically exempted from sales and use tax are identified in GS. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

This document serves as notice that effective January 1 2009 there is a new exemption from State sales and use tax for bakery items sold without eating utensils by an artisan bakery. North Carolina Department of Revenue. The Forsyth County Sales Tax is collected by the merchant on all qualifying sales made within Forsyth County.

Historical Total General State Local and Transit Sales and Use Tax Rates. Average Local State Sales Tax. In North Carolina certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

PO Box 25000 Raleigh NC 27640-0640. But youd only charge the uniform reduced rate of 2 local tax on the loaf of bread. If you are looking for additional detail you may wish to utilize the Sales Tax Rate Databases which are provided in a comma separated value CSV format.

This tax is administered by the county and is not subject to the exemption. 725 Sales and Use Tax Chart. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC state rate and 225 Cherokee County rate on the toothbrush and the candy.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Sales of these items will be subject to the 2 local rate of tax imposed on qualifying food products. This page describes the taxability of food and meals in North Carolina including catering and grocery food.

General Sales and Use Tax. NORTH CAROLINA 475 4 NORTH DAKOTA 5 OHIO 575 OKLAHOMA 45. See Why Were Americas 1 Tax Preparer.

This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. Total General State Local and Transit Rates Tax Rates Effective 1012020 Historical Total General State. Food sales subject to local taxes.

NC Sales Tax Rates by City. The Forsyth County North Carolina sales tax is 675 consisting of 475 North Carolina state sales tax and 200 Forsyth County local sales taxesThe local sales tax consists of a 200 county sales tax. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants.

The exemption only applies to sales tax on food purchases. 35 rows Sales and Use Tax Rates Effective October 1 2020 Skip to main. A customer buys a toothbrush a bag of candy and a loaf of bread.

North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax. NC State is not exempt from the prepared food and beverage taxes administered by local counties and municipalities. Sales Tax Exemptions in North Carolina.

7 Sales and Use Tax Chart. Maximum Local Sales Tax. This exemption should only be used for direct purchases.

With local taxes the total sales tax rate is between 6750 and 7500. Maximum Possible Sales Tax. Food Non-Qualifying Food and Prepaid Meal Plans.

Showing 1 to 6 of 6 entries. While the North Carolina sales tax of 475 applies to most transactions there are certain items that may be exempt from taxation. HI ID KS OK and SD.

North Carolina Department of Revenue. As a state agency the University is exempt from North Carolina sales and use tax for qualifying purchases effective July 1 2004.

I Went Grocery Shopping At Walmart For The First Time And Saved Almost 50 On My Food Bill

Is Food Taxable In North Carolina Taxjar

New Online Class How To Make Money Selling Groceries On Amazon

Sales Tax On Grocery Items Taxjar

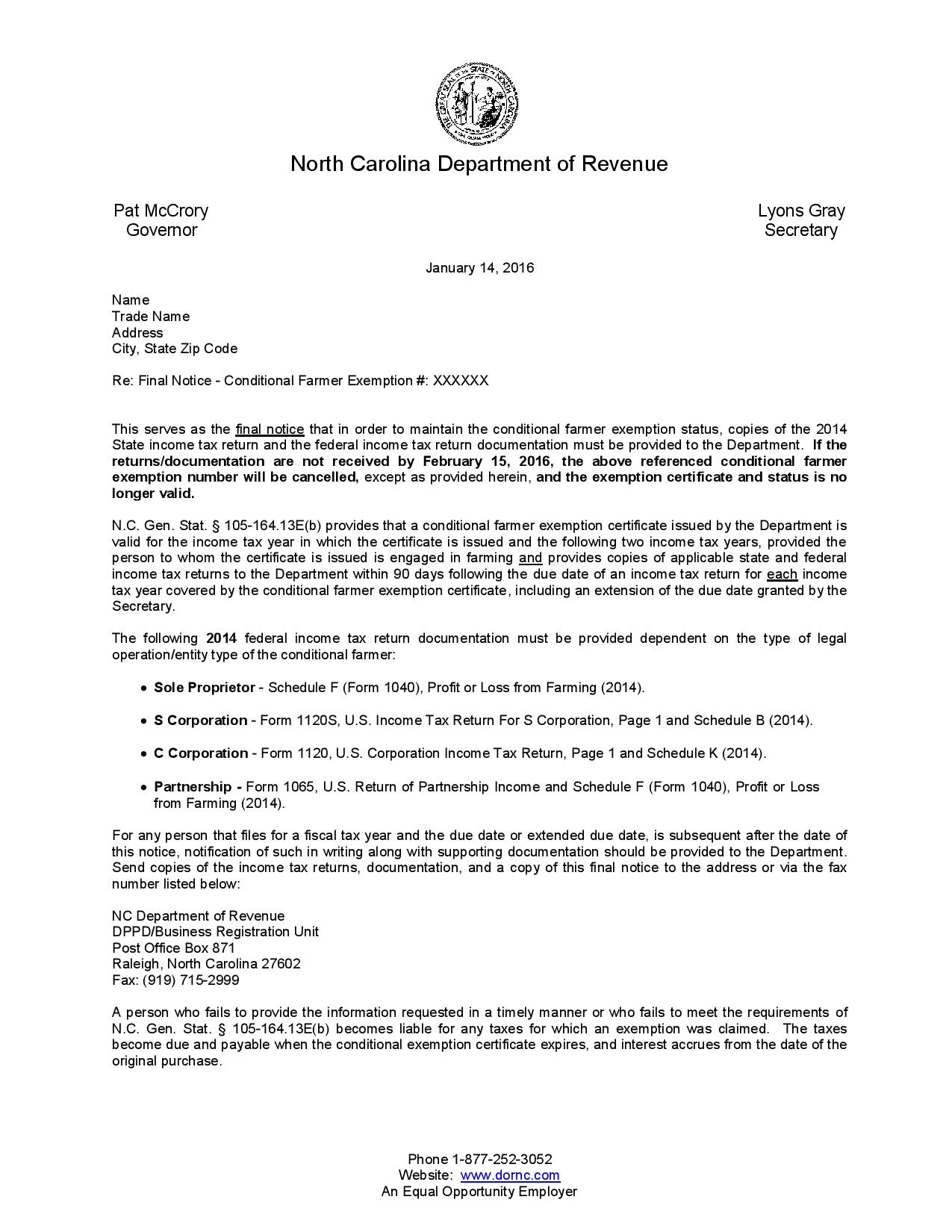

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Red And White Shop State Clothes Nc State Wolfpack Spirit Shirts

Peppermint And Winterfresh Candy Pattern 137 Primitive Doll Pattern Christmas Whimsical Fiber Art English Only

Green Cone Solar Food Waste Digester Composter Etsy Composter Solar Thermal Food Waste

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Is Food Taxable In North Carolina Taxjar

2020 Sales Tax Holiday Plastic Drop Cloth Hurricane Supplies Disaster Prep

Happy Birthday Gold Silver Or Rose Gold Mirror Acrylic Circle Script Cake Topper Cake Decoration Cake Accessories

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Hunter Nc State Pet Combo Set Collar Lead Id Tag